Understanding Fapiao: China’s Official Invoice System

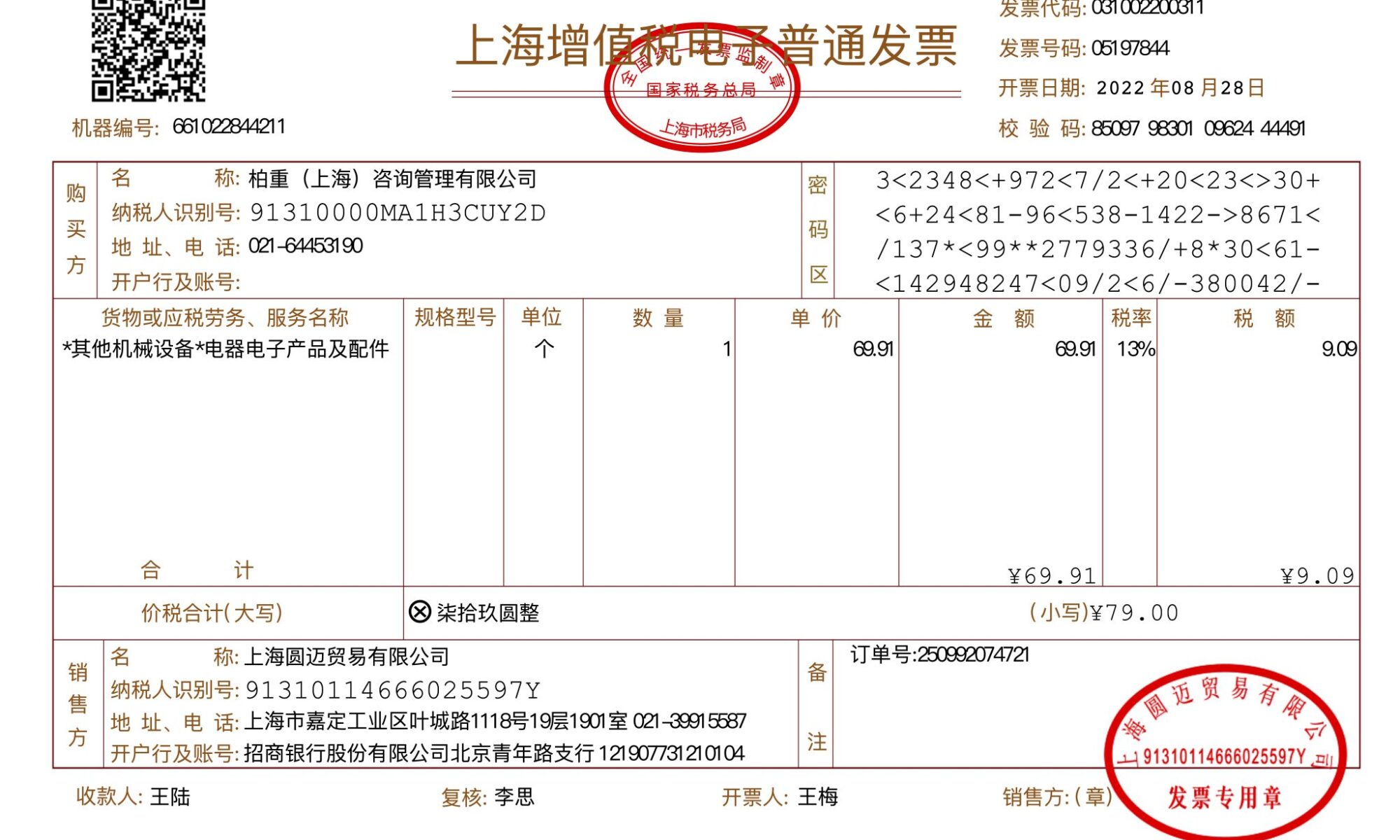

A Fapiao (发票) is the official tax invoice issued in the People's Republic of China that serves as proof of purchase for goods and services. Unlike ordinary receipts used in many countries, fapiaos are strictly controlled legal documents issued by the State Taxation Administration (STA) and carry significant importance for both businesses and consumers.

Key Characteristics of Fapiao

1. Government-Regulated Documents

· Printed on specially designed, anti-counterfeiting paper

· Contain unique serial numbers tracked by tax authorities

· Issued only through government-approved systems

· Feature multiple security elements (watermarks, special ink, etc.)

2. Two Main Types of Fapiao

VAT Special Fapiao (增值税专用发票)

· Used primarily for business-to-business transactions

· Allows purchasers to claim input VAT credits

· Contains detailed information about both buyer and seller

· Required for companies to deduct taxes

VAT Ordinary Fapiao (增值税普通发票)

· Used for business-to-consumer transactions

· Issued to individuals or entities not requiring VAT deduction

· Simpler format with fewer details required

Why Fapiao Matters in China

For Businesses

· Legal Compliance: Required for all business transactions

· Tax Deductions: Essential for claiming input VAT credits

· Accounting Records: Legally recognized proof of expenditure

· Audit Trail: Mandatory for financial audits and inspections

For Individuals

· Expense Reimbursement: Required by most employers

· Warranty Claims: Often necessary for product guarantees

· Personal Tax Deductions: Certain fapiaos can reduce personal tax

· Legal Protection: Proof of purchase in consumer disputes

The Digital Transformation: Electronic Fapiao

E-Fapiao Adoption

Since 2015, China has been progressively implementing electronic fapiaos:

· Legally Equivalent: Same legal status as paper versions

· Enhanced Features: QR codes, digital signatures, easier verification

· Environmental Benefits: Reduced paper consumption

· Convenience: Instant delivery via email or mobile apps

How to Obtain E-Fapiao

1. Seller generates invoice through tax bureau system

2. Customer provides taxpayer identification number

3. Invoice sent electronically via official channels

4. Accessible through tax bureau platforms or dedicated apps

How to Request and Use Fapiao

Standard Process

1. At Point of Purchase: Request fapiao from the seller

2. Provide Information: For businesses: company name, taxpayer ID, address, phone, bank account

3. Receive Invoice: Paper or electronic format

4. Verification: Check details and authenticity via official channels

5. Accounting: File appropriately for tax or reimbursement purposes

Important Information to Provide

· For Companies: Complete legal name (as registered), 15-digit taxpayer identification number, registered address, phone, bank account details

· For Individuals: Name and sometimes ID number (for high-value items)

Common Fapiao Challenges

1. Reluctant Issuance

Some businesses may avoid issuing fapiaos to evade taxes. Consumers have the right to insist and can report violations to local tax authorities (hotline: 12366).

2. Fake Fapiaos

Counterfeit invoices exist despite security features. Always verify suspicious fapiaos through official tax bureau websites or apps.

3. Lost Fapiaos

Reissuing is difficult and often requires official explanations to tax authorities. Digital fapiaos eliminate this risk.

4. Cross-Region Issues

Fapiaos issued in one province may require additional verification when used in another.

Special Fapiao Categories

1. Motor Vehicle Sales Fapiao

Required for all vehicle purchases and registrations

2. Used Motor Vehicle Fapiao

Specific format for second-hand vehicle transactions

3. Blockchain Electronic Fapiao

Pilot program using blockchain technology for enhanced security

4. Tourism Industry Fapiao

Special formats for travel services

Tax Implications and Compliance

Input VAT Credit

Businesses use special fapiaos to claim input VAT credits, reducing their overall tax liability. This requires:

· Accurate fapiao information

· Timely certification (within 360 days)

· Proper accounting treatment

Deductible Expenses

Only expenses with valid fapiaos are tax-deductible for corporate income tax purposes.

Digital Verification

All fapiaos must be verified through the Golden Tax System before use in tax deductions.

Practical Tips for Foreigners and Businesses

1. Always Request Fapiao: For any significant purchase or business expense

2. Carry Taxpayer Information: Keep a card with your company's fapiao details

3. Understand Different Types: Know when you need special vs. ordinary fapiao

4. Use Digital Options: Prefer e-fapiao when available for easier management

5. Maintain Organization: Keep fapiaos well-organized for accounting and audits

6. Verify Authenticity: Check suspicious fapiaos immediately

7. Know Your Rights: Sellers are legally obligated to issue fapiaos upon request

Future Developments

China continues to reform its fapiao system with:

· Complete digitalization by 2025

· Integration with blockchain technology

· Simplified processes for small businesses

· Enhanced cross-border invoice recognition

· Mobile-first solutions for consumers

The fapiao system is more than just an invoice—it's a fundamental component of China's tax administration and business environment. Understanding how to properly obtain, verify, and use fapiaos is essential for anyone conducting business, working, or living in China. As the system evolves toward complete digitalization, both businesses and individuals will benefit from increased efficiency and transparency while maintaining rigorous tax compliance standards.

For specific questions about fapiao requirements in particular situations, always consult with a qualified tax professional or local tax authority, as regulations may vary by region and industry.