中国主要企业税种 (不含香港税务制度)

这张文章要介绍中国大陆主要企业税种,既是利得税及增值税。

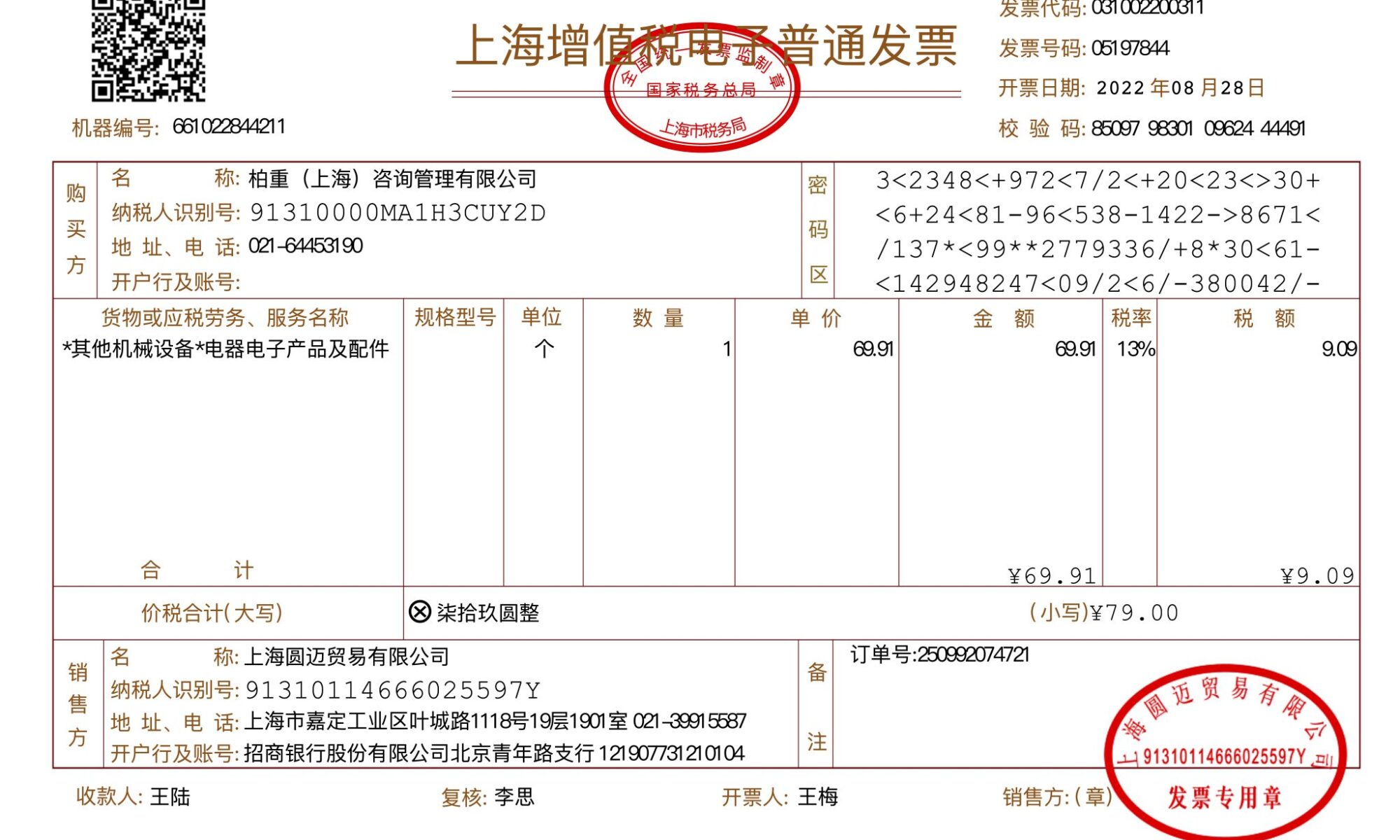

1) 增值税

货品正常增值税率为13%. 税金每个月要交付。

政府发票的月额是计算税金的基础。

所有的政府发票在税务局要注册。税务局也可以限制发票的金额和总数,也有能力监督公司所开的政府发票。

一个时期来看公司所开的政府发票额(公司发票也要受到款项)要减去公司所收到的供应商发票(供应商发票应该全额支付的)。差额的13%要通过指定银行账户来付。

增值税不涉及大部分服务,比方说运输等。

小企业、销售额不超过70万的企业、第一年开业的企业,增值税率也可以下降。

2) 利得税。

政府发票的季度额是计算利得税的基础。

销售额不超过300万的企业,利得税只是5%。销售额超过300万的企业,利得税为25%。

很多城市及地区有税务政策的区别,有一些货品也会有优惠税率,比方说创新品、环保产品。

上述的税率涉及位于广州做正常产品的公司。