In the world of Hong Kong business, few documents hold as much fundamental importance as the Certificate of Incorporation (CI). It is the official “birth certificate” of your limited company, the definitive proof of its legal existence issued by the Hong Kong government. For any entrepreneur or investor, understanding what the CI is, what it contains, and why it’s indispensable is the first step in establishing a credible and compliant enterprise.

What Exactly is the Certificate of Incorporation?

The CI is a formal document issued by the Companies Registry of Hong Kong upon the successful registration of a new company under the Companies Ordinance (Cap. 622). It marks the moment the company becomes a distinct legal entity, separate from its shareholders (owners) and directors (managers).

Think of it this way:

· Company Name Approval = Getting approval for a baby’s name.

· Filing Incorporation Forms = Submitting the birth registration paperwork.

· Issuance of the CI = Receiving the official birth certificate from the government.

Key Information Contained on the CI

The CI is a concise but powerful document that typically includes:

1. Company Name: Your registered business name in English and/or Chinese.

2. Company Number: A unique, permanent registration number (e.g., 1234567). This is your company’s official identifier for all government dealings.

3. Date of Incorporation: The official “birthday” of the company. This date is crucial for determining the financial year-end and filing deadlines.

4. A Official Declaration: A statement certifying that the company is incorporated under the Companies Ordinance and that the Registrar of Companies has registered it.

5. Registrar’s Seal & Signature: The official stamp and signature from the Companies Registry, authenticating the document.

Why is the CI So Important? Its Critical Functions

The CI is not just a formality; it is the bedrock of your company’s legal and commercial identity.

1. Proof of Legal Existence & Limited Liability

· It is the primary evidence that your company exists as a legal “person” in Hong Kong law. This legal separation is what establishes limited liability, protecting shareholders’ personal assets from company debts (barring exceptional circumstances like personal guarantees).

2. Mandatory for Opening a Corporate Bank Account

· No reputable bank in Hong Kong or overseas will open a corporate bank account without reviewing the original or certified copy of the CI. It is the first document in any bank’s KYC (Know Your Customer) checklist.

3. Essential for Business Operations & Contracts

· You will need to provide the CI to secure business licenses, apply for office leases, register for trademarks, enter into significant contracts, and establish lines of credit with suppliers. It verifies to third parties that they are dealing with a legitimate, registered entity.

4. Foundation for Compliance

· Your CI number and incorporation date are used for all subsequent compliance filings, including:

· Annual Returns to the Companies Registry.

· Profits Tax Returns to the Inland Revenue Department (IRD).

· Business Registration renewal.

5. Building Credibility and Trust

· Presenting a CI instantly enhances your company’s credibility with clients, investors, and partners, signaling that your business is properly established and transparent.

The CI in Relation to Other Key Documents

It’s vital to distinguish the CI from other essential Hong Kong company documents:

· Business Registration Certificate (BRC): Issued by the IRD, this is a tax registration document. The CI proves existence, while the BRC grants the permission to operate as a business for tax purposes. You need both.

· Articles of Association (AA): This is the company’s internal “constitution,” outlining its rules on shareholder rights, director powers, and meeting procedures. The CI incorporates the company under these rules.

· Company Seal (Chop): While less mandatory today, the company seal often embosses the CI number onto official documents. The CI validates the authority of the seal.

How to Obtain a Certificate of Incorporation

The CI is obtained by filing an application for company incorporation (Form NNC1 for a company limited by shares) with the Companies Registry, along with the AA and the required fee. This process is almost always handled by:

· A professional corporate services provider, or

· A Hong Kong solicitor or CPA.

They ensure the application is accurate and complete, preventing delays. Upon approval, you will receive the CI in digital (PDF) form via the government’s e-registry platform, which is as legally valid as the paper version.

Practical Advice & Cautions

· Safe Keeping: Store the original digital file and any certified printed copies securely. It is a crucial corporate document.

· Certified True Copies: For many official uses (e.g., opening a bank account abroad), you will need a “Certified True Copy” of the CI, attested by a practicing Hong Kong solicitor, notary, or your corporate service provider.

· Verification: Anyone can verify the authenticity of a Hong Kong company and view its CI details (for a small fee) through the Companies Registry’s Cyber Search Centre online.

· Not a Trading License: Remember, the CI allows the company to exist, but it does not grant permission for specific regulated activities (e.g., finance, food service), which require separate licenses.

The Certificate of Incorporation is the non-negotiable foundation of your Hong Kong company. It is the single most important piece of paper that transforms a business idea into a recognized legal entity with the rights, protections, and responsibilities afforded by Hong Kong law. Whether you are a startup founder or a seasoned investor, securing and safeguarding your company’s CI is the first and most critical step in your journey toward building a successful and enduring enterprise in Asia’s world city.

Navigating Business Licenses in Hong Kong: A Guide to Compliance and Operations

Hong Kong is globally celebrated for its ease of doing business and pro-enterprise environment. A common misconception, however, is that its free-market ethos means no regulatory oversight. While the process is generally straightforward, understanding business licensing in Hong Kong is a critical step for ensuring your venture operates legally and avoids significant penalties. The core principle is that while most general businesses don’t need a universal “business license” to incorporate, many specific activities require sector-specific licenses or permits.

The Foundational Registration: Not a “License”

First, it’s essential to distinguish between business registration and a business license.

· Business Registration Certificate (BRC): This is mandatory for all entities operating a business in Hong Kong, obtained from the Inland Revenue Department (IRD). It is a tax registration document, not an operational license. It provides your Business Registration Number (BRN) and must be renewed annually or triennially.

· Company Incorporation: Registering a limited company with the Companies Registry is a separate process that creates your legal entity. The Certificate of Incorporation is your “birth certificate,” while the BRC is your “tax ID.”

The real licensing requirement depends entirely on your business nature.

Common Business Activities Requiring Licenses

Licenses are typically administered by specific government departments or regulatory bodies. Here are key sectors where licenses are paramount:

1. Financial Services

This is the most heavily regulated sector. Key regulators include the Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA).

· Required For: Banking, securities trading, asset management, money lending, insurance brokerage, and financial advising.

· Key Point: SFC licenses are complex, involve “fit and proper” tests for personnel, and require demonstrating adequate capital and compliance systems.

2. Food & Beverage and Hospitality

· Restaurants/Cafes: Require a Food Business License from the Food and Environmental Hygiene Department (FEHD). Premises must pass stringent health, safety, and hygiene inspections.

· Hotels & Guesthouses: Require a Hotel/Guesthouse License from the Office of the Licensing Authority (Home Affairs Department), ensuring building safety and fire regulations are met.

3. Retail and Trade

· Dangerous Goods: Selling items like fireworks, chemicals, or compressed gases requires a license from the Fire Services Department.

· Pharmaceuticals: Retail and wholesale of medicines requires a license from the Department of Health (Pharmaceutical Service).

· Liquor Sales: A Liquor License from the Liquor Licensing Board is needed for any premises selling alcohol for on-site consumption.

4. Education and Training

· Private Schools & Tutorial Centers: Must be registered with or exempted by the Education Bureau, complying with curriculum, safety, and staffing requirements.

5. Travel and Tourism

· Travel Agencies: Require a Travel Agent’s License from the Travel Industry Authority (TIA), which includes a guarantee and specific staff qualifications.

6. Others

· Employment Agencies: License from the Labour Department.

· Telecommunications: Licenses from the Office of the Communications Authority (OFCA).

The Critical Process: How to Determine and Obtain Licenses

1. Determine Your Business Nature: Clearly define your company’s proposed activities. Consult the Hong Kong Government’s “Licensing Service” website, a comprehensive one-stop portal listing hundreds of licenses.

2. Identify the Licensing Authority: Each license is managed by a specific department. Direct consultation with them is often advisable.

3. Fulfill Premises Requirements: Many licenses (F&B, hotel, retail) are premises-specific. You cannot get the license before securing a premises that passes the relevant inspections (health, fire, building safety). Never sign a long-term lease contingent on obtaining a license without legal advice.

4. Submit the Application: Prepare the required forms, supporting documents, business plans, technical specifications, and personal details of directors/shareholders. Processing times can vary from weeks to several months for complex applications.

5. Pay Fees and Undergo Inspection: Pay the application and license fees. Be prepared for site inspections by government officers.

6. Receive License and Comply with Conditions: Once granted, the license will have attached conditions (e.g., operating hours, safety protocols) that must be strictly followed. Renewal is typically required periodically.

Why Compliance is Non-Negotiable

· Legal Repercussions: Operating without a required license is a criminal offense, leading to heavy fines and potential imprisonment.

· Business Disruption: Authorities can issue suspension orders, forcing you to cease operations immediately.

· Civil Liability: Invalidates insurance and exposes you to lawsuits.

· Reputational Damage: Loss of trust from clients, partners, and financial institutions.

Practical Advice for Entrepreneurs

· Seek Professional Guidance: Engage a corporate services firm or a local solicitor early in your planning stage. Their expertise is invaluable in navigating the licensing maze, especially for regulated sectors.

· Factor in Time and Cost: Licensing can be a significant pre-operational cost (professional fees, government charges, premises modifications) and time investment. Include this in your business plan and launch timeline.

· “When in Doubt, Check”: The Hong Kong government is generally approachable. If uncertain, contact the relevant department directly for pre-application advice.

Hong Kong’s licensing regime is designed to protect public interest, safety, and market integrity without unduly stifling entrepreneurship. The system is transparent and predictable. Success lies in due diligence. Understanding and securing the necessary business licenses is not a bureaucratic hurdle but a fundamental step in building a credible, sustainable, and fully compliant Hong Kong enterprise. Proper planning in this area lays a solid foundation for your business’s future growth and protects you from severe operational and legal risks.

Why Your Business Needs a Local Representative in Hong Kong?

Hong Kong stands as one of the world’s most dynamic gateways to Asia and beyond. Its low-tax regime, robust legal framework, and unparalleled connectivity make it a magnet for international business. However, navigating its unique market—a blend of deep Chinese roots and international business practices—requires more than just a mailing address. This is where the critical role of a local representative comes into play. Whether an individual, a hired professional, or a professional services firm, having “boots on the ground” is often the deciding factor between success and struggle.

Beyond a Formality: The Multifaceted Role

A local representative is your company’s physical presence, eyes, ears, and voice in Hong Kong. Their value extends far beyond mere compliance to become a core strategic asset.

1. Navigating Legal and Regulatory Compliance

Hong Kong’s legal environment, while business-friendly, has specific, non-negotiable requirements. A local representative ensures you stay on the right side of the law.

· Company Secretary Mandate: Every Hong Kong incorporated company must appoint a local company secretary. A professional representative fulfills this role, handling annual filings, maintaining statutory registers, and ensuring compliance with the Companies Ordinance.

· Liaison with Authorities: They act as the official point of contact for the Inland Revenue Department (IRD), the Companies Registry, and other government bodies, managing communications, tax filings, and audit processes.

· Understanding Nuances: They interpret local regulations, advise on licenses specific to your industry (e.g., financial services, trading), and ensure your business structure remains compliant as laws evolve.

2. Enabling Market Entry and Cultural Navigation

Entering a new market is fraught with unseen challenges. A local representative de-risks this process.

· Cultural and Linguistic Bridge: They navigate the subtleties of guanxi (relationships) in business, communicate effectively in Cantonese, Mandarin, and English, and ensure your brand message is culturally appropriate.

· Local Knowledge: They provide insights into consumer behavior, competitive landscape, and local marketing channels that you cannot glean from reports alone.

· Administrative Setup: From finding an office and negotiating leases to setting up utilities and bank accounts, they handle the time-consuming logistics that can overwhelm a remote team.

3. Driving Business Development and Trust

Presence builds credibility. A local representative actively grows your business.

· Networking and Partnerships: They attend industry events, chamber meetings, and trade fairs to build a network, identify distributors, agents, or joint-venture partners on your behalf.

· Sales and Client Management: They can conduct face-to-face meetings, provide local after-sales support, and build stronger, trust-based relationships with clients and suppliers than is possible remotely.

· Brand Representation: Having a physical, responsive presence signals long-term commitment to the market, enhancing your brand’s reputation and reliability.

4. Managing Operational Efficiency

Day-to-day management from afar is inefficient and prone to errors.

· HR and Recruitment Support: They can help navigate local labor laws, assist in hiring initial staff, and act as a local manager for a remote team.

· Logistics and Supply Chain Coordination: For trading or manufacturing businesses, they can oversee quality control, liaise with suppliers in the Greater Bay Area, and manage logistics hubs.

· Problem-Solving: When issues arise—be it a delayed shipment, a client dispute, or a bureaucratic hurdle—a local representative can address them in real-time, during local business hours.

Who Can Act as Your Local Representative?

· Professional Employer Organization (PEO)/Global Employment Partner: For testing the market without establishing a legal entity, they can legally hire and manage employees on your behalf.

· Professional Services Firm: Firms specializing in corporate services, accounting, or legal can provide company secretarial services and high-level compliance and advisory support.

· Hired Local Employee: Your first direct hire, such as a Country Manager or Business Development Director, can fulfill this role, combining representation with direct operational control.

· Nominee Services: For specific legal or privacy requirements, nominee director or shareholder services can be used, though these are typically combined with professional firm support.

The Cost of Not Having a Representative

The alternative—managing Hong Kong operations from a foreign headquarters—often leads to:

· Compliance Risks: Missed filings, penalties, and potential legal issues.

· Operational Delays: Inability to react quickly to opportunities or problems.

· Cultural Missteps: Damaged relationships and brand perception.

· Lost Opportunities: Lack of local intelligence and network means missing out on deals and trends.

For any foreign company serious about the Hong Kong and Greater China market, a local representative is not merely an administrative requirement; it is a strategic investment. They provide the essential local intelligence, operational agility, and trusted presence that transforms a market entry plan into tangible, sustainable growth. In the competitive and fast-paced environment of Hong Kong, being truly “on the ground” is the ultimate advantage.

In short, a local representative is your key to unlocking Hong Kong’s full potential while ensuring you navigate its complexities with confidence and compliance.

How to Claim VAT Refund for a Chinese Export Company

For Chinese companies engaged in export activities, the Value-Added Tax (VAT) refund mechanism represents a crucial financial benefit that significantly enhances international competitiveness. China’s export tax rebate policy, administered by the State Taxation Administration (STA), allows eligible exporters to recover VAT paid on purchased materials and services used in manufacturing exported goods.

This comprehensive guide outlines the systematic process for Chinese export companies to successfully claim VAT refunds.

1. Eligibility Requirements

Qualified Exporters

· Enterprises with import-export rights registered with Chinese authorities

· Companies engaged in the export of goods or processing trade

· Entities in good standing with tax compliance records

· Businesses with proper accounting systems and documentation practices

Eligible Transactions

· Direct export of self-produced or purchased goods

· Entrusted export services

· Export through comprehensive bonded zones

· Special regional export arrangements

2. Key Documentation Requirements

Essential Documents for VAT Refund Application

1. Customs Declaration Forms

· Electronically filed customs declarations (EDI)

· Verified export records with official customs stamps

2. Commercial Documents

· Sales contracts or purchase orders

· Commercial invoices detailing transaction values

· Packing lists and shipping documents

· Bill of Lading or Air Waybill as proof of export

3. Financial Records

· VAT special invoices (fapiao) for purchased inputs

· Export sales invoices

· Bank settlement receipts for export proceeds

· Payment verification documents

4. Administrative Documents

· Business license and tax registration certificates

· Import-export enterprise qualification certificate

· Electronic port IC card or equivalent digital access

3. Step-by-Step Refund Process

Phase 1: Pre-Export Preparation

· Register for export tax refund privileges with local tax authorities

· Establish proper accounting classifications for export transactions

· Implement systems to segregate domestic and export sales

· Obtain necessary software for electronic filing (typically “出口退税申报系统”)

Phase 2: Post-Export Documentation

1. Collect Documentation

· Obtain customs declaration forms upon shipment clearance

· Secure all commercial and financial documents

· Verify receipt of export proceeds (within regulated timeframe)

2. Foreign Exchange Verification

· Register export proceeds with State Administration of Foreign Exchange (SAFE)

· Ensure compliance with foreign exchange control regulations

· Obtain electronic verification data

3. Invoice Certification

· Submit VAT invoices for input tax certification

· Complete cross-verification between purchase and sales invoices

· Address any discrepancies before filing

Phase 3: Refund Application

1. Electronic Filing

· Prepare refund application using official tax software

· Enter all transaction data accurately

· Generate electronic application package

2. Submission

· Submit application through electronic tax bureau system

· Provide required hard copies if requested by authorities

· Meet monthly or quarterly filing deadlines (typically the 15th day following the reporting period)

3. Audit and Verification

· Tax authorities conduct preliminary review (usually 5-20 working days)

· Possible on-site verification for large claims or new exporters

· Respond promptly to any inquiries or requests for additional documentation

4. Calculation Methods

Primary Refund Methods

1. Exemption, Credit, and Refund Method (免、抵、退税)

· Most common method for production enterprises

· Calculated based on input VAT credits against domestic and export liabilities

· Formula: Refund Amount = (FOB Value × Refund Rate) – Deductible Credit

2. Tax Refund Method (退税)

· Typically for trading companies

· Direct refund based on purchased product value and refund rate

· Formula: Refund Amount = Purchase Value × Refund Rate

Refund Rates

· Vary by product category (typically 0%, 6%, 9%, 13%)

· Regularly updated by Ministry of Finance and STA

· Check official announcements for specific product classifications

5. Special Considerations and Compliance

Timing Requirements

· Apply within prescribed periods (usually within 90 days following the export year)

· Strict adherence to foreign exchange receipt deadlines

· Regular filing schedules to maintain compliance

Common Challenges and Solutions

1. Documentation Errors

· Implement triple-check systems for all documents

· Train specialized staff in documentation requirements

· Maintain digital backups of all records

2. Classification Disputes

· Seek advance rulings for new products

· Consult with customs brokers or tax specialists

· Monitor changes in product classification guidelines

3. Audit Triggers

· Maintain consistent documentation practices

· Avoid sudden spikes in refund claims

· Keep thorough records of all calculations

Risk Management

· Implement internal controls for export documentation

· Regular reconciliation between accounting, sales, and logistics

· Professional consultation for complex transactions

· Stay updated on regulatory changes

6. Digital Transformation and Recent Updates

Electronic Processing

· Mandatory electronic filing in most regions

· Integration between customs, tax, and foreign exchange systems

· Automated data matching reducing manual verification

Recent Policy Developments

· Simplified procedures for qualified exporters

· Increased automation in review processes

· Pilot programs for instant refunds to certain enterprises

· Enhanced compliance monitoring through big data analytics

7. Professional Support Recommendations

When to Seek Expertise

· First-time export operations

· Complex product classifications

· Large-volume refund claims

· Discrepancies or audits by tax authorities

· Expansion into new export markets or products

Service Providers

· Specialized tax consultants with export expertise

· Licensed tax agents (税务师)

· Customs brokerage firms with tax advisory services

· Accounting firms with international trade divisions

Conclusion

Successfully navigating China’s VAT refund system requires meticulous documentation, procedural compliance, and staying current with regulatory updates. For export companies in China, an efficient VAT refund process represents not just a compliance requirement but a significant financial optimization opportunity that directly impacts competitiveness in global markets.

By establishing robust internal systems, leveraging digital tools, and seeking professional guidance when needed, Chinese exporters can maximize their VAT recoveries while maintaining full compliance with evolving regulations.

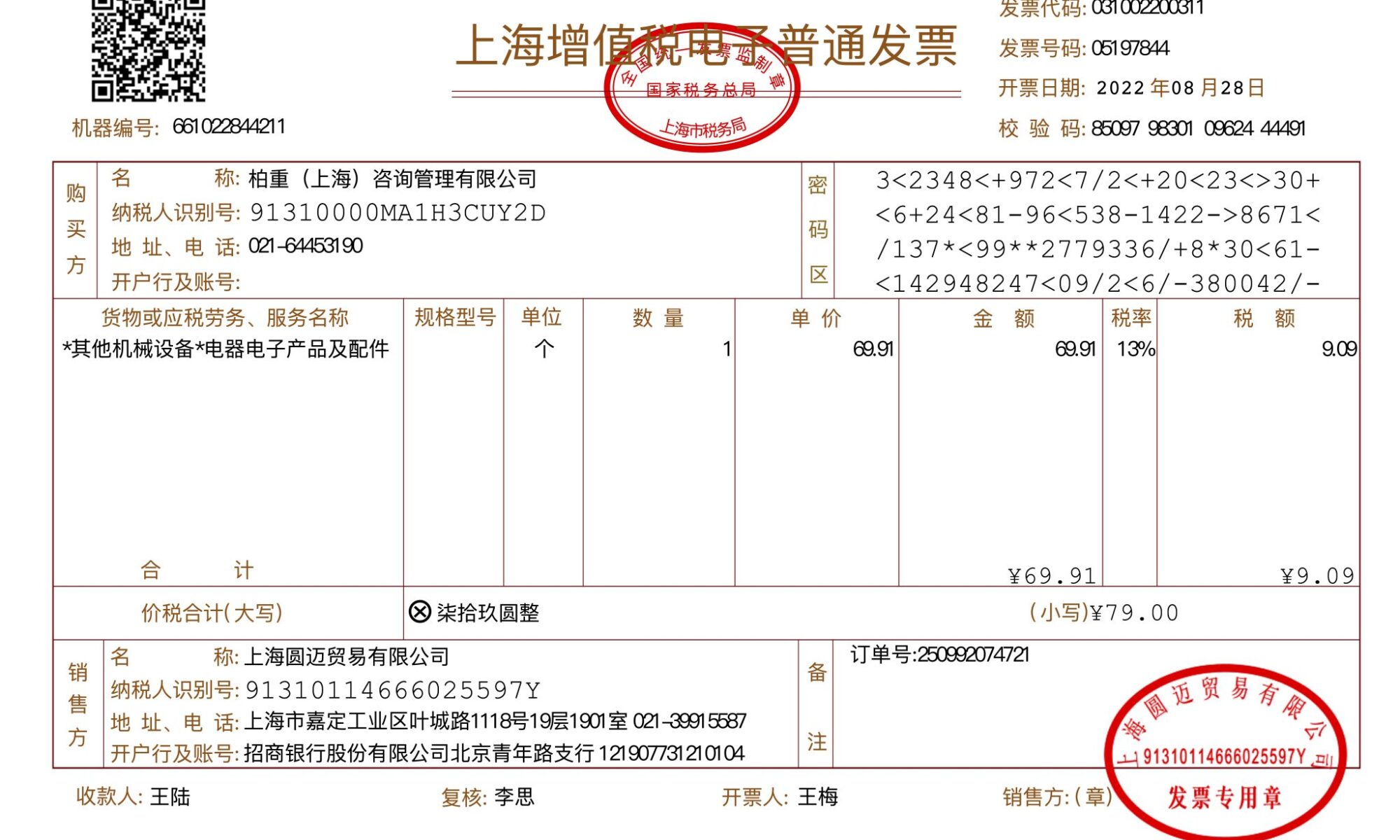

Understanding Fapiao: China’s Official Invoice System

A Fapiao (发票) is the official tax invoice issued in the People’s Republic of China that serves as proof of purchase for goods and services. Unlike ordinary receipts used in many countries, fapiaos are strictly controlled legal documents issued by the State Taxation Administration (STA) and carry significant importance for both businesses and consumers.

Key Characteristics of Fapiao

1. Government-Regulated Documents

· Printed on specially designed, anti-counterfeiting paper

· Contain unique serial numbers tracked by tax authorities

· Issued only through government-approved systems

· Feature multiple security elements (watermarks, special ink, etc.)

2. Two Main Types of Fapiao

VAT Special Fapiao (增值税专用发票)

· Used primarily for business-to-business transactions

· Allows purchasers to claim input VAT credits

· Contains detailed information about both buyer and seller

· Required for companies to deduct taxes

VAT Ordinary Fapiao (增值税普通发票)

· Used for business-to-consumer transactions

· Issued to individuals or entities not requiring VAT deduction

· Simpler format with fewer details required

Why Fapiao Matters in China

For Businesses

· Legal Compliance: Required for all business transactions

· Tax Deductions: Essential for claiming input VAT credits

· Accounting Records: Legally recognized proof of expenditure

· Audit Trail: Mandatory for financial audits and inspections

For Individuals

· Expense Reimbursement: Required by most employers

· Warranty Claims: Often necessary for product guarantees

· Personal Tax Deductions: Certain fapiaos can reduce personal tax

· Legal Protection: Proof of purchase in consumer disputes

The Digital Transformation: Electronic Fapiao

E-Fapiao Adoption

Since 2015, China has been progressively implementing electronic fapiaos:

· Legally Equivalent: Same legal status as paper versions

· Enhanced Features: QR codes, digital signatures, easier verification

· Environmental Benefits: Reduced paper consumption

· Convenience: Instant delivery via email or mobile apps

How to Obtain E-Fapiao

1. Seller generates invoice through tax bureau system

2. Customer provides taxpayer identification number

3. Invoice sent electronically via official channels

4. Accessible through tax bureau platforms or dedicated apps

How to Request and Use Fapiao

Standard Process

1. At Point of Purchase: Request fapiao from the seller

2. Provide Information: For businesses: company name, taxpayer ID, address, phone, bank account

3. Receive Invoice: Paper or electronic format

4. Verification: Check details and authenticity via official channels

5. Accounting: File appropriately for tax or reimbursement purposes

Important Information to Provide

· For Companies: Complete legal name (as registered), 15-digit taxpayer identification number, registered address, phone, bank account details

· For Individuals: Name and sometimes ID number (for high-value items)

Common Fapiao Challenges

1. Reluctant Issuance

Some businesses may avoid issuing fapiaos to evade taxes. Consumers have the right to insist and can report violations to local tax authorities (hotline: 12366).

2. Fake Fapiaos

Counterfeit invoices exist despite security features. Always verify suspicious fapiaos through official tax bureau websites or apps.

3. Lost Fapiaos

Reissuing is difficult and often requires official explanations to tax authorities. Digital fapiaos eliminate this risk.

4. Cross-Region Issues

Fapiaos issued in one province may require additional verification when used in another.

Special Fapiao Categories

1. Motor Vehicle Sales Fapiao

Required for all vehicle purchases and registrations

2. Used Motor Vehicle Fapiao

Specific format for second-hand vehicle transactions

3. Blockchain Electronic Fapiao

Pilot program using blockchain technology for enhanced security

4. Tourism Industry Fapiao

Special formats for travel services

Tax Implications and Compliance

Input VAT Credit

Businesses use special fapiaos to claim input VAT credits, reducing their overall tax liability. This requires:

· Accurate fapiao information

· Timely certification (within 360 days)

· Proper accounting treatment

Deductible Expenses

Only expenses with valid fapiaos are tax-deductible for corporate income tax purposes.

Digital Verification

All fapiaos must be verified through the Golden Tax System before use in tax deductions.

Practical Tips for Foreigners and Businesses

1. Always Request Fapiao: For any significant purchase or business expense

2. Carry Taxpayer Information: Keep a card with your company’s fapiao details

3. Understand Different Types: Know when you need special vs. ordinary fapiao

4. Use Digital Options: Prefer e-fapiao when available for easier management

5. Maintain Organization: Keep fapiaos well-organized for accounting and audits

6. Verify Authenticity: Check suspicious fapiaos immediately

7. Know Your Rights: Sellers are legally obligated to issue fapiaos upon request

Future Developments

China continues to reform its fapiao system with:

· Complete digitalization by 2025

· Integration with blockchain technology

· Simplified processes for small businesses

· Enhanced cross-border invoice recognition

· Mobile-first solutions for consumers

The fapiao system is more than just an invoice—it’s a fundamental component of China’s tax administration and business environment. Understanding how to properly obtain, verify, and use fapiaos is essential for anyone conducting business, working, or living in China. As the system evolves toward complete digitalization, both businesses and individuals will benefit from increased efficiency and transparency while maintaining rigorous tax compliance standards.

For specific questions about fapiao requirements in particular situations, always consult with a qualified tax professional or local tax authority, as regulations may vary by region and industry.

Where to Set Up Your Base: A Guide to Hong Kong’s Office Rental Districts

Hong Kong’s dynamic landscape offers a diverse array of districts for establishing an office, each with its unique character, advantages, and price points. Choosing the right location is a strategic decision that impacts your brand image, talent acquisition, operational costs, and client accessibility. Here’s a breakdown of Hong Kong’s key office districts to help you decide.

1. The Central Business Districts (CBD): Prestige & Power

These are the epicenters of global finance and professional services, offering unmatched prestige and connectivity.

· Central & Admiralty: The heart of Hong Kong’s financial world. Home to iconic skyscrapers like the IFC and Bank of China Tower, top law firms, banks, and hedge funds. It boasts the best transportation links (MTR, ferries), luxury amenities, and a dense concentration of talent. This comes at the highest cost per square foot globally.

· Best for: Finance, law, investment firms, multinational headquarters where prestige and proximity to clients are paramount.

· Tsim Sha Tsui (Tsim Sha Tsui) East, Kowloon: A major CBD on the Kowloon side, known for its grand harborside office towers (like ICC – International Commerce Centre, one of Hong Kong’s tallest buildings). It offers stunning harbour views, excellent MTR connections (including the Airport Express), and slightly more competitive rents than Central, though still in the premium tier. The atmosphere is modern and corporate.

· Best for: Finance, logistics, trading companies, and businesses that value a Kowloon address with superb transport links to the airport and mainland China.

2. Core Commercial & Mixed-Use Hubs: Vibrant & Connected

These districts provide a vibrant mix of business, retail, and lifestyle, often at a relative value compared to the core CBD.

· Wan Chai & Causeway Bay: Immediately east of Central, these areas offer a lively blend of Grade A and Grade B offices, government offices, convention centers (HKCEC), and sprawling retail. Rents are lower than Central, and the environment is more energetic. Causeway Bay is a retail paradise, while Wan Chai has a strong presence of media, advertising, and trade companies.

· Best for: PR & marketing, design, trading, SMEs, startups seeking a central location with great amenities and a slightly faster pace.

· Island East (Quarry Bay, Taikoo Place): Has transformed into a massive, self-contained business hub anchored by Taikoo Place (Swire). It hosts major corporations (e.g., many insurance and tech firms) in state-of-the-art, efficient towers. The area is less congested, offers excellent MTR access, and has a wide range of dining and retail options within complexes. Rents offer good value compared to Central.

· Best for: Corporate back-offices, tech companies, insurance, engineering, and large organizations seeking high-quality space in a planned, efficient environment.

3. Emerging & Niche Areas: Value & Specialization

These districts attract businesses looking for specific advantages, character, or lower costs.

· Wong Chuk Hang & Aberdeen (Southside): Once industrial, this area has rapidly gentrified into a trendy hub for creative industries. It offers spacious, converted industrial spaces and new developments at significantly lower rents than the north shore of Hong Kong Island. While MTR access is now available, it’s slightly more remote.

· Best for: Creative agencies, architects, tech startups, wellness brands, and businesses prioritizing spacious, character-filled offices over a central address.

· Kowloon Bay & Kwun Tong (East Kowloon): Traditional industrial areas that have been revitalized with modern commercial towers. They offer some of the most competitive rental rates in the market, good transport links, and a large local workforce. The environment is practical and no-frills.

· Best for: Logistics, wholesale, manufacturing, IT services, and SMEs seeking cost-effective, functional space with strong local connections.

· Kowloon West (Cheung Sha Wan, Sham Shui Po): An emerging node with new commercial developments like Lai Sun Commercial Centre and One Midtown. It provides modern office stock at very attractive prices compared to Tsim Sha Tsui. The area is well-connected by MTR and is undergoing significant regeneration.

· Best for: Tech companies, e-commerce, sourcing offices, and businesses looking for modern facilities on a budget in an up-and-coming location.

4. The Future & Decentralization: New Frontiers

· Kai Tak & Hung Hom: The massive Kai Tak development area is Hong Kong’s largest urban regeneration project. It promises a future waterfront business cluster, a cruise terminal, and extensive sports and recreational facilities. Currently in early stages, it represents a long-term bet on a new, planned CBD in Kowloon.

· The Northern Metropolis: A long-term strategic vision focusing on innovation and technology integration with Shenzhen. While primarily a future plan, it signals potential for tech and R&D hubs in the northern New Territories.

Key Decision Factors

1. Budget: Rents can vary by over 100% between Central and Kowloon West. Define your budget per square foot.

2. Business Image & Client Needs: Do you need a prestigious address for client meetings, or is a creative, functional space more important?

3. Employee Access: Consider where your current and potential employees live. Proximity to major MTR hubs is a huge advantage.

4. Industry Cluster: Being near peers, partners, or clients (e.g., banks in Central, creatives in Wong Chuk Hang) can be beneficial.

5. Space Requirements: Need large, open floors? Character? High-spec finishes? This narrows down building types and districts.

There is no single “best” district in Hong Kong—only the best fit for your specific business needs.

· For maximum prestige & global finance: Central/Admiralty.

· For a balanced, vibrant corporate hub: Wan Chai/Causeway Bay or Island East.

· For Kowloon-based prestige & connectivity: Tsim Sha Tsui East.

· For value, space, and a creative vibe: Wong Chuk Hang or Kowloon West.

· For the most cost-effective, functional space: Kwun Tong/Kowloon Bay.

Ultimately, a thorough assessment of your operational priorities, coupled with viewing spaces in a few shortlisted districts, will lead you to the ideal Hong Kong base for your next chapter of growth.

Apostille of Documents in Hong Kong

An apostille is a specialized certificate that authenticates the origin of a public document (like birth certificates, court orders, or notarized documents) for use in another country. It is issued under the terms of the 1961 Hague Convention Abolishing the Requirement of Legalisation for Foreign Public Documents. Hong Kong, as a Special Administrative Region of China, continues to apply the Hague Apostille Convention separately.

Why is an Apostille Needed in Hong Kong?

If you have a Hong Kong public document that must be presented in another country that is also a member of the Hague Apostille Convention (e.g., the USA, Japan, Germany, Australia), you will likely need an apostille. It simplifies the legalization process, replacing the more cumbersome chain of authentications.

Procedure in Hong Kong:

The High Court of Hong Kong is the designated Competent Authority for issuing apostilles.

1. Document Type: Ensure your document is a “public document.” This includes:

· Original documents issued by Hong Kong government departments (birth/death/marriage certificates, company registry extracts).

· Documents notarized by a Hong Kong notary public (affidavits, powers of attorney, copies of passports).

· Official documents signed by certain other officials (e.g., court documents).

2. Submission: You or your legal representative must submit the original document (or a notarized copy) to the Apostille Section of the High Court Registry.

3. Processing: The Court verifies the signature/seal on the document. Once confirmed, they attach or stamp the apostille certificate onto the document.

4. Time & Cost: Processing is typically fast, often within one working day. Fees apply and should be confirmed on the Hong Kong Judiciary website.

Important Notes:

· For use in Mainland China: Since Mainland China is a member of the Hague Convention but applies it differently to Hong Kong, documents destined for the Mainland usually require a different process called “Legalisation” through the China Legalisation Office in Hong Kong, not a simple apostille.

· For use in non-Hague Convention countries: Full legalization through consulates or embassies is required.

Always check the specific requirements of the receiving country before proceeding.

The Essential Guide to Secretary Services in Hong Kong

In the dynamic and competitive business hub of Hong Kong, professional secretary services are not just an administrative convenience—they are a strategic necessity. For both multinational corporations and ambitious startups, these services provide the foundation for compliance, efficiency, and professional credibility.

More Than Just Paperwork: The Role of a Company Secretary

In Hong Kong, the role of a company secretary is legally mandated by the Companies Ordinance. Every incorporated company must appoint one. This goes far beyond traditional administrative tasks. A qualified company secretary ensures strict adherence to Hong Kong’s regulatory framework, managing critical filings with the Companies Registry and the Inland Revenue Department.

Core Services Offered:

1. Statutory Compliance: Timely submission of annual returns, notification of changes in directors/shareholders, and maintenance of statutory books.

2. Board & Shareholder Support: Arranging meetings, preparing agendas, taking minutes, and facilitating resolutions.

3. Registered Office Address: Providing a prestigious local business address, which is a legal requirement.

4. Mail Handling & Virtual Office: Receiving and forwarding official correspondence, sometimes bundled with telephone answering services.

5. Ad-hoc Administrative Support: Assistance with document preparation, liaison services, and other tasks to streamline operations.

Why Outsource? Key Benefits:

· Ensure Compliance: Avoid hefty penalties and legal risks by relying on experts who are up-to-date with changing regulations (e.g., the new Trust and Company Service Provider (TCSP) licensing regime).

· Cost Efficiency: Eliminate the need for a full-time, in-house executive, saving on salary, benefits, and office space.

· Access to Expertise: Gain insights from professionals who are often qualified accountants or lawyers with deep knowledge of Hong Kong corporate law.

· Focus on Core Business: Free up leadership to concentrate on strategy, growth, and revenue-generating activities.

· Enhanced Professional Image: A reputable secretary service provider lends immediate credibility to your business.

Choosing the Right Provider When selecting a secretary service firm in Hong Kong, consider their licensing (TCSP license), reputation, range of services, technology platform for document access, and the responsiveness of their team. Whether you are establishing a new presence or optimizing an existing one, a proficient company secretary is your partner in navigating the complexities of Hong Kong business, allowing you to operate with confidence and integrity.

Share Capital in Hong Kong: Requirements, Structure, and Key Considerations

When incorporating a private limited company in Hong Kong, one of the fundamental decisions founders must make concerns the company’s share capital. Hong Kong’s corporate regime, governed by the Companies Ordinance (Cap. 622), is known for its flexibility and business-friendly approach. This is particularly evident in its rules regarding share capital, which offer significant freedom to entrepreneurs.

1. No Mandatory Minimum Paid-Up Capital

A key advantage of incorporating in Hong Kong is that there is no statutory minimum amount of paid-up share capital. A company can be formed with a share capital as low as HK$1.00. This low barrier to entry facilitates easy startup formation and is a major reason for Hong Kong’s vibrant entrepreneurial ecosystem.

· Important Note: While there is no minimum for general companies, specific regulated industries (e.g., licensed financial institutions, insurance companies, securities firms) have their own capital requirements imposed by regulatory bodies like the Securities and Futures Commission (SFC) or the Hong Kong Monetary Authority (HKMA).

2. Understanding Key Terminology: Authorized vs. Issued Share Capital

Under the current Companies Ordinance, the concept of “authorized share capital” has been abolished for companies incorporated after its enactment. The focus is now on:

· Authorized Share Capital (for older companies): Pre-2014 companies may still have a clause in their Articles of Association limiting the maximum number of shares they can issue. This can be removed by a special resolution.

· Issued Share Capital: This refers to the total value of shares that have actually been allotted (issued) to shareholders. This is the figure that represents the capital held by the company.

3. Currency Flexibility

A company’s share capital can be denominated in any currency (or multiple currencies), providing great flexibility for international businesses. The most common choices are Hong Kong Dollars (HKD), US Dollars (USD), or Chinese Renminbi (RMB). The chosen currency must be clearly stated in the company’s incorporation documents (Form NNC1) and its Articles of Association.

4. Types of Shares and Share Rights

Hong Kong law allows for different classes of shares, each with distinct rights attached. The most common is the ordinary share, which typically carries one vote per share and equal rights to dividends and capital. However, companies can create:

· Preference Shares: Offering a fixed dividend priority but usually no voting rights.

· Redeemable Shares: Shares that the company can buy back under agreed terms.

· Shares with Different Voting Rights (e.g., Weighted Voting Rights): Permitted under specific rules, often used by listed companies.

The rights, privileges, and restrictions of each share class must be explicitly defined in the company’s Articles of Association.

5. Payment for Shares

Shares can be paid for in several ways:

· Cash: The most straightforward method.

· Non-Cash Consideration (Assets or Services): Shares can be issued in exchange for the transfer of assets (e.g., intellectual property) or past services. It is crucial to have a proper valuation and record this in board minutes.

Paid-up vs. Unpaid Capital: While capital can be issued, it does not necessarily have to be fully paid up immediately. For example, a company with HK$10,000 in issued capital may have only HK$2,000 paid up by shareholders, leaving HK$8,000 as unpaid capital (a debt owed by shareholders to the company). However, for most small private companies, it is standard and recommended to have the issued capital fully paid up upon incorporation to simplify matters.

6. Increasing or Reducing Share Capital

· Increasing Capital: A common procedure. The company, by an ordinary resolution, can create new shares and issue them to existing or new shareholders.

· Reducing Capital: More complex and requires a special resolution (75% shareholder approval) and court confirmation unless it falls under a specific solvency-based procedure outlined in the Companies Ordinance. This process ensures creditor protection.

7. Practical Considerations and Common Pitfalls

· Not Just a Formality: While the amount can be small, the structure of share capital is a critical legal foundation. It affects control (voting), profit distribution (dividends), and liability.

· Adequacy for Operations: While the legal minimum is HK$1, the issued capital should be reasonable and adequate for the company’s intended business operations and initial expenses.

· Public Record: The details of a company’s issued share capital are part of its public file at the Companies Registry, accessible by anyone.

· Stamp Duty: A fixed duty of HK$5 is payable on the return of allotment (Form NSC1) for issued shares, regardless of the capital amount or currency.

Hong Kong’s approach to share capital is characterized by maximum flexibility and minimal red tape, aligning with its status as a premier global business hub. The absence of a mandatory minimum paid-up capital removes a significant financial barrier for startups. However, this flexibility demands careful planning. Founders should thoughtfully determine the amount, currency, and class structure of shares, ensuring it is documented correctly in the Articles of Association. For any non-standard capital structure or questions regarding adequacy, seeking advice from a corporate service provider or legal professional is highly recommended to lay a solid foundation for future growth and investment.

Choosing the Right Company Address in Guangzhou

Establishing a company in Guangzhou, the commercial heart of Southern China, is a strategic move. Your business address is more than just a location; it’s a statement about your company’s profile, credibility, and ambitions. Selecting the right district can significantly impact your operations, client perception, and access to talent.

Key Business Districts in Guangzhou:

1. Tianhe District (天河区) – The Modern CBD

· Profile: The undisputed financial and commercial core of Guangzhou. It’s home to skyscrapers, multinational corporations, and high-end shopping malls.

· Ideal For: Finance, IT, consulting, legal firms, multinational corporations, and any business that requires a prestigious image.

· Landmarks: Guangzhou Twin Towers (CTF Finance Centre & Guangzhou International Finance Place), Tianhe Sports Center, Zhujiang New Town.

· Advantages: Top-tier infrastructure, excellent transportation (multiple metro lines), high concentration of talent and clients.

· Considerations: The highest office rental costs in the city.

2. Yuexiu District (越秀区) – The Traditional & Political Center

· Profile: The historical heart of Guangzhou, hosting the provincial and municipal government offices. It blends traditional commerce with political significance.

· Ideal For: Government relations (lobbying), traditional trading companies, legal firms, NGOs, and cultural enterprises.

· Landmarks: Beijing Road Pedestrian Street, Yuexiu Park, Provincial Government Headquarters.

· Advantages: Established business environment, strong government resources, rich cultural history.

· Considerations: Older infrastructure, traffic congestion can be an issue.

3. Haizhu District (海珠区) – The Emerging & Creative Hub

· Profile: Known for its innovation and creativity, anchored by the massive Guangzhou International Convention and Exhibition Center (Pazhou Complex).

· Ideal For: E-commerce, tech startups, advertising, media, and all companies involved in import/export trade and exhibitions.

· Landmarks: Canton Fair Complex, Guangzhou Tower (across the river), Pazhou Internet Innovation Cluster.

· Advantages: Modern exhibition facilities, growing tech scene, relatively more affordable than Tianhe.

· Considerations: Still developing in some areas, traffic can be heavy during major events like the Canton Fair.

4. Nansha District (南沙区) – The Free Trade Zone & Future Gateway

· Profile: A national-level New Area and Free Trade Zone located by the Pearl River Estuary. It focuses on advanced manufacturing, shipping, and international trade.

· Ideal For: Manufacturing, logistics, international trade, shipping companies, and businesses looking for significant tax incentives and policy support.

· Landmarks: Nansha Port, Nansha Free Trade Zone.

· Advantages: Attractive tax benefits, streamlined customs procedures, ample space for development.

· Considerations: Far from the city center (about 1-hour drive), still under large-scale development.

Important Considerations When Choosing an Address:

· Virtual Offices & Serviced Offices: For startups and small businesses, serviced offices (e.g., Regus, Sparkeagle) or virtual office services provide a prestigious address and secretarial services without the cost of a full lease. This is a highly popular and cost-effective way to start.

· Legal Registration: The address must be suitable for commercial use and able to be registered with the local Administration for Market Regulation (市场监督管理局). Not all residential or mixed-use properties can be registered.

· Accessibility: Proximity to metro stations (e.g., Lines 3, 5, and the APM in Tianhe) is a major advantage for both employees and clients.

Final Steps:

Once you select a district, work with a local real estate agent who specializes in commercial property. They can help you navigate the leasing process, ensure the property can be legally registered, and negotiate favorable terms. Your address in Guangzhou will be the foundation of your brand’s story in one of the world’s most dynamic economies.